Download White Papers: Decoding the DNA of Profitable Customers

Executive Summary

Supply Velocity Client had engaged our research team to help them identify factors that would enable them to predict or identify potential profitable customers. Our team was able to determine that five of the seven factors (independent variables) that were discussed in our initial meeting were good predictors of gross profit per customers. Key customer, customers that purchase on the web, customers that are located in coastal states, the number employees at a customer and the population of the customers’ billing zip code were all shown, to improve the average profit per customer with all other factors held constant. Sunshine percent of the state and the median income of the zip code of the customer’s billing address did not help in predicting gross profit per customer (Statistically not significant).

Problem Statement

The problem we were engaged to solve was to help predict which prospects are likely to be highly profitable customers for Supply Velocity Client. By understanding the attributes of a highly profitable customer, Supply Velocity Client can effectively target its marketing campaigns and resources. At Supply Velocity Client the marketing campaign is primarily conducted by mailing out printed catalogues to customers and to rented mailing lists. By targeting their marketing efforts, Supply Velocity Client may be able to reduce rental fees for mailing lists and reduce the numbers of catalogues mailed. In addition, Supply Velocity Client can use the predictions from this analysis to assign existing sales representatives to higher profit potential prospects. The goal was to build a model that would help Supply Velocity Client achieve greater expected gross profit (sales minus standard cost) and lower overall marketing expenses.

Performance & Predictor Variables

Our team met with the CEO and Director of Marketing to discuss the performance variable (also known as dependent variable) we want to predict and the variables that would help predict the performance variable (also known as independent variables). There were many viable candidates for performance variables; some of the variables we discussed include customer-loyalty measures, volume measures and profit measures. The team came to a mutual agreement along with Eric and Katherine that the best performance variable to help Supply Velocity Client improve profit was gross profit per customer. Gross profit was calculated as sales dollars minus standard cost per item sold.

Next we discussed the independent variables that could predict gross profit per customer. Some variables were suggested by our team, while other variables were suggested by the CEO and Director of Marketing. A key consideration for the selection of a variable was the availability of data, either within the systems at Landscapes Brands or in the public domain of the web. The independent variables selected are as follows:

- Key customer: Key customer was a binary variable (1 = key customer, 0 = not). Key customers were determined exogenously by Supply Velocity Client. If a customer had $20,000 in sales in a single year or $5000 per year over three years they were designated a key customer.

- Whether the customer ordered product via Supply Velocity Client’ web site or over the phone: Web Y/N was a binary variable (1 = order via web site, 0 = order via phone).

- Whether the customer was located in a coastal state: Supply Velocity Client manufactures outdoor furnishings that are highly corrosion resistant. Therefore, management wondered if customers in coastal states, where outdoor furnishings are more prone to corrosion were the more profitable customers.

- The sunshine percentage of the state the customer was located within: Supply Velocity Client also a wondered the effect of sunshine, i.e. how sunny/rainy the location of the customer was on total profit. We used sunshine percent of the state as a proxy for sunniness of customers’ locale.

- The number of employees of the customer: Most of Supply Velocity Client’ customers are privately held businesses. Supply Velocity Client paid a data firm to overlap the number of employees of these companies, from other data sources, onto their customer base. We used this as a proxy for customer size.

The marketing team at Supply Velocity Client wondered if the income and population affected customer profit. The hypothesis would be that companies ordering from areas having higher median incomes and companies ordering from more populated areas purchased more products. We were able to acquire median income and population by zip code from the 2000 census. This data was matched to customer billing zip code.

- The median income of the zip code that the customer was located within,

- The population of the zip code that the customer was located within.

Note: All of the customer location variables were based on customers’ billing addresses for orders, rather than on the addresses to which orders were shipped.

These variables were used in single and multiple-variable regression models to predict gross profit per customer.

Data Summary

Our original database had over 74,000 customers, 50,505 of which had employee data. Due to time constraints and the statistical significance of customer employee count in our fitted model, we chose to conduct our analyses using the sample of customers with employee counts. Also to be noted is that one of the customers without an employee count was the armed forces. This one customer had total gross profit over 10 times more than the second highest total gross profit customer. We believe this customer was an outlier that significantly skewed the data, and that removal of this customer was appropriate. Below are some descriptive statistics on the variables used in this analysis.

- The average gross profit per customer = $1333

- The average orders per customer = 1.57

- There were 284 key customers in our data set of 50,505 customers

- 13,641 customers ordered via the web

- 26,331 customers were located in coastal states

- The least sunny state had sunshine percentage of 37.6%, the sunniest state had sunshine percentage of 84.5%, and the average was 60%

- The fewest employees per customer was 1, the most was 11,000, and the average was 51.9

- The lowest median income for a customer billing zip code of was $2499, the highest was $200,001 and the average was $47,714

- The lowest population for a customer billing zip code was 5 people, the highest was 143,987 and the average was 24,818

Supply Velocity Client’ products last a very long time and they warrantee their products for seven years. Therefore, many customers will order one time and not need to replace these products for many years. To capture enough customers and repeat business we therefore used data that was cumulative for 2006 through 2011. In addition, we randomly set aside 10% of the customers to test the predictive power of our models.

Prediction Model Discussion

We created multiple-variable regression models to predict gross profit per customer using two approaches. The first approach, called the direct model predicted gross profit per customer directly from all of the independent variables identified for the study. Five of the seven independent variables proved to be statistically significant. Sunshine percentage and population of the customer’s zip code were not statistically significant. Therefore, we removed these variables from the regression model, and used only the remaining five statistically significant independent variables in our model.

In the second approach we used two steps to predict gross profit per customer. First, we fit a model using the same seven independent variables to predict orders per customer, and then we fit a second model to predict gross profit per order. We calculated gross profit per customer by multiplying orders per customer by gross profit per order. All seven independent variables were statistically significant in both models.

Results – Direct Model

The direct gross profit per customer prediction model used five independent variables. The effects of these variables on gross profit per customer will be discussed briefly below. The R-square of this model was 0.0738. This means that the five independent variables predicted 7.38% of the observed variation in profit per customer. Therefore, 92.62% of the variation in gross profit per customer is due to other untested variables. While the predictive value of the model may seem low, we will show why it has good predictive power.

Direct Gross Profit Prediction Equation

Gross profit per customer = 425.66 + 19977(KeyCustomerYes) + 741.93(WebYes) + 332.83(CoastalStateYes) + 1.29(EmployeeCount) + 0.0074(ZipInc.)

The coefficients in the model were all positive. For the binary (yes-no) independent variables (key customer, web-yes, coastal state), when a customer had one of these attributes, all other variables held constant, the average profit of these customers will be higher by the value of the coefficient.

- A key customer, with all other variables held constant, will have an average gross profit $19,977 higher than non key customers

- Customers that use the web, with all other variables held constant, will have an average gross profit $741.94 higher than customers that call in orders

- Customers located in coastal states, with all other variables held constant, will have an average gross profit $332.83 higher than non coastal state customers

For the continuous independent variables (employee count, population of the zip code) an increase of 1 person (employee or resident), with all other variables held constant, will increase the average profit per customer by the value of the coefficient.

- For each customer employee, with all other variables held constant, a customer will on average have gross profit $1.29 higher

- For each $1000 of median income in a customer’s zip code, with all other variables held constant, a customer in that zip code will on average have gross profit $7.4 higher

Because the average profit per customer is $1,332, even the median income coefficient of 0.0074 is economically meaningful. A company in a zip code with $10,000 higher median income, will, with all other variables held constant, have on average gross profit $74 higher. This is about a 5% increase in gross profit per customer for every $10,000 in median income of their zip code.

It should also be noted that the individual regressions of the five independent variables to gross profit per customer had correlation coefficients that were also statistically significant and had positive slopes. This is further verification that these independent variables are good predictors of gross profit per customer.

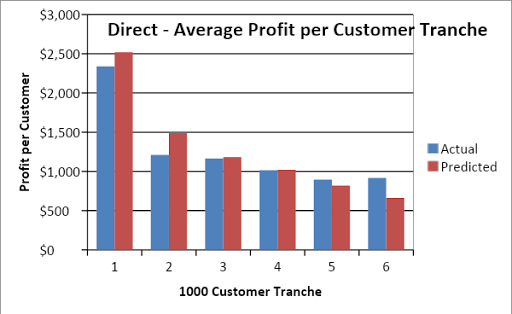

We tested the fitted models’ predictive powers by using the estimating equation for the fitted model with the set-aside customer data. These set-aside customers were not used to create the prediction model. Using the values of the five independent variables for the 5,664 set-aside customers we calculated each customer’s predicted gross profit. We then sorted these from highest to lowest and grouped them into tranches of 1,000 customers and calculated the average gross profit per customer for each tranche. Note, the last tranche was the bottom 564 customers. The results of the actual versus predicted gross profit per customer is shown below in Table 1 and Figure 1. It is apparent that the direct profit per customer prediction model did a good job, overall. Of the six tranches, four are in the correct order. Only the bottom two tranches should be reversed. In addition, the errors are relatively small.

| 1000 Customer Tranche | Actual Average Decile Profit per Customer | Predicted Average Decile Profit per Customer | Error |

| 1 – 1000 | $2,339 | $2,519 | 7.73% |

| 1001 – 2000 | $1,211 | $1,489 | 22.97% |

| 2001 – 3000 | $1,165 | $1,180 | 1.30% |

| 3001 – 4000 | $1,015 | $1,020 | 0.52% |

| 4001 – 5000 | $896 | $818 | 8.70% |

| 5001 – 5664 | $917 | $661 | 27.88% |

Table 1: Actual versus Predicted Average (over the 1000 customer tranche) Gross Profit per Customer for the Direct Model

Figure 1: Actual versus Predicted Average (over the 1000 customer tranche) Gross Profit per Customer for the Direct Model

Results – Two Stage Model

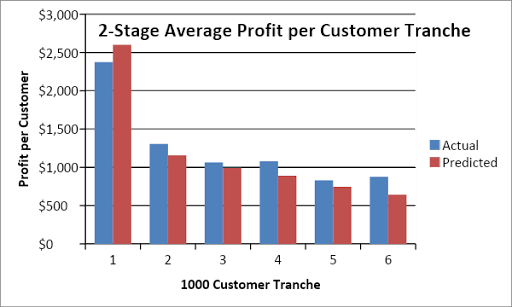

Our second approach used two steps to calculate gross profit per customer. The two stage model’s overall predictive power was very similar to the direct model. The graph of actual versus predicted gross profit for the 1,000 customer tranches looks very similar. The R-squares for the orders and profit per order multiple variable regression models were slightly lower for these models than the direct model. Therefore we will focus our conclusions on the direct model.

| 1000 Customer Tranche | Actual Average Decile Profit per Customer | Predicted Average Decile Profit per Customer | Error |

| 1 – 1000 | $2,374 | $2,601 | 9.57% |

| 1001 – 2000 | $1,304 | $1,159 | 11.13% |

| 2001 – 3000 | $1,065 | $991 | 6.94% |

| 3001 – 4000 | $1,079 | $892 | 17.34% |

| 4001 – 5000 | $830 | $746 | 10.07% |

| 5001 – 5664 | $878 | $643 | 26.70% |

Table 2: Actual versus Predicted Average (over the 1000 customer tranche) Gross Profit per Customer for the Two Stage Model

Figure 2: Actual versus Predicted Average (over the 1000 customer tranche) Gross Profit per Customer for the Two Stage Model

Conclusion

This analysis began with Supply Velocity Client asking if the seven independent variables could predict profitable customers. This information would be used to rent direct mail lists and choose customers and prospects to receive a mailed catalogue; and to determine which customers and prospects may get assigned to a senior sales representative. Because of the statistical significance of the prediction model, the significance of the five independent variables and the test of the model versus actual profit per customer, it is our recommendation that Supply Velocity Client should use these five variables (key customer, customers that purchase on the web, customers that are located in coastal states, greater number employees at a customer and greater median income of the customers’ billing zip code ) to select where to expend marketing and sales resources. Each variable, with all other variables held constant, predicts a more profitable customer.

Possible Next Steps

Due to time constraints our team gathered geographic data in the most expeditious manner possible. Our population and income data was taken from the 2000 US census. The 2010 US census data was not readily accessible at the time of the study. We believe it would be beneficial to revisit this analysis using the latest US census data once it is generally available in a downloadable dataset. The designation of “coastal” and sunshine percent was based on the customer billing state. Sunshine percent was averaged from national oceanic administration data for cities within these states. Some customers had multiple billing addresses. We manually had to aggregate the data for these customers into the state/zip that appeared to have the greatest activity. We believe further work to find the appropriate geographic area to use for these variables, would improve the reliability of the model. Choices include zip code, county, metropolitan statistical area (MSA) and state. Further, several larger customers shipped to multiple states, some of which were geographically dispersed from the billing state. We believe further work to assess the viability of shipping state and zip code as predictors is appropriate.

As stated above the direct profit per customer prediction model predicted only 7.38% of the variation of profit per customer. This indicates there are other variables that account for profit per customer. Additional discussion, using a cause and effect diagram, could discover additional potential independent variables. If data was readily available for these variables they could be added to the prediction model to determine if the variables improve the model’s predictive power.

There is an important independent variable that was not included in this analysis, which likely helps predict gross profit per customer. That variable is the number of catalogues mailed to each customer. Given more time we would recommend adding this variable to the prediction model.

Some of the independent variables were correlated with each other. This may have caused hidden nonlinearities and may require further investigation.

Finally, we find the results for Web-Yes intriguing. Customers that buy on the web versus call in orders are on average, and with all other variables held constant, more profitable. We wondered if Supply Velocity Client has suggested selling hints on their web site that drive this behavior. Since web-ordering customers are, all other variables held constant, more profitable, perhaps we can use suggested selling to increase sales and profit even more. In addition, could the company incent its customers to buy on the web, where the firm may have an improved opportunity to sell its customers more products using cross-selling techniques? Perhaps a coupon would provide that incentive. We recommend that such activities, if pursued, should include a study component to better understand the possible causal elements that lead to positive customer response and improved profitability.

Ask us your Lean, Six Sigma, or Supply Chain question.

We’re the experts! We’ll get back within 48 hrs. with a valuable response.

"*" indicates required fields

“Supply Velocity’s Lean Six Sigma System has given us new tools to help improve our sales performance. We have learned new ways to analyze our business which makes problem solving more accurate and has made us better leaders.”

“We are using Supply Velocity’s Lean Six Sigma methods to analyze a variety of processes including rationalizing SKUs (stock-keeping-units). By using math to evaluate SKUs we took some of the emotion out of our decisions. We expect significant increases in sales and productivity from reducing poor performing SKUs.”

“Mitch Millstein and his team helped guide our shop fabrication division in the re-layout of our custom pipe and steel fabrication facility when we moved into a new building. It is not only the results but how he helped. We were involved in every step. I personally did time studies and was able to see the non-value added steps required to manufacture in our old layout. When we created our new layout, everyone was involved, from the executive team to our direct labor force. With Mitch’s help we increased our throughput by a 3x multiple, while providing more competitive prices to our clients as a result of the efficiency improvements.This has enabled us to not only make more money but also to expand our commercial reach and serve more, and larger customers. I would recommend Supply Velocity to any company that wants to make improvement in supply chain and operations.”

“In the spring of 2003, the St. Louis Area Chapter of the American Red Cross engaged Supply Velocity, Inc. to perform a study and make recommendations to streamline office processes, maximize cash flow in purchasing and warehousing and restructure and enhance our maintenance department. Supply Velocity, Inc.’s process was methodical, flexible, staff-oriented, inclusive and, above all, trackable.In the last six months, our Chapter has realized expense savings of over $380,000 annually, and significant improvement in intra-company service levels has been attained. Supply Velocity, Inc. will return to the Chapter periodically throughout the next 18 months to audit our newly implemented processes. We have been pleased with our results and Supply Velocity, Inc.’s professionalism.”

“In a time of volatile supply chain disruption, Supply Velocity is helping us develop Demand and Supply Planning processes to proactively tackle these new challenges. They are genuine partners, working with our team, facilitating and teaching.”

“Myerson engaged Supply Velocity, specifically Ray Davis to visit our plant in Trinidad to conduct a two day assessment of our production procedures and provide us feedback on areas for improvement and where applicable, areas for future analysis.Put simply, we got everything we paid for and in addition to more in depth analysis, we got specific tasks that were immediately actionable. Our local management team found Ray to be engaging, highly credible and insightful based on his wide experience. In other words the cultural differences and lack of specific industry knowledge weren’t impediments to things we could implement immediately and on our own. In a nutshell it was money well spent and will pay itself back many times over.”

“Many thanks to all three Supply Velocity presenters. I think you guys took a very difficult time for learning and capitalized on everyone’s time and training needs. I truly hope this helps your business as this was a considerable undertaking on the part of Supply Velocity. Outstanding!!”

“For several years we have worked with Supply Velocity to support us with their expertise on Lean Operations and Supply Chain Management. Supply Velocity has helped us implement Lean, improve our inventory systems, and educate our people. They are professionals who are always available to help us as needed.”

“In 2015 we began working with Dr. Mitch Millstein to optimize our inventory locations supporting e-commerce and in-store inventory needs. From this work we developed a new omni-channel warehousing and inventory plan that entirely redefined our approach to warehousing, inventory management, store distribution and fulfillment. As a result of the analyses by Dr. Millstein we have begun the move to an improved omni-channel design by reassigning MSAs to new warehouses, greater leveraging of in-store inventories to satisfy e-commerce demands, and exploring acquisitions of new warehousing space in strategic locations. We have already seen an improvement of $300,000 from both more efficient shipping strategies due to better inventory management.”

“In thirty years of hiring consultants, Supply Velocity, Inc. was the first to tell me what they were going to do, set a price they stuck to and substantially exceed my expectations. I have recommended them to friends and acquaintances. They were true partners in assisting with the turnaround of an acquisition we had been struggling with for two years.Their math-based technology, solid down-to-earth facilitation skills, and positive, patient and enthusiastic attitude combined to make our implementation of Lean a very rewarding experience.

We increased our production by 50% in the first month of implementation and continue to see improvements. Improvements have not only been realized in productivity, but also in quality and morale. We have increased profitability by $2M on flat sales of $10M.

Based on Supply Velocity, Inc.’s integrity and our results, I will continue to refer them to others and utilize them in the future as we expand our company through acquisitions.”

“Supply Velocity created visibility within our Assurance Services Group… visibility of performance, Client-service, employee satisfaction and processing time. Using the Supply Velocity System, Audit Report Cycle time is down over 50%. We are using his strategies to create greater Client loyalty.”

“I am thrilled to provide this testimonial for Supply Velocity and their outstanding work in implementing Lean Warehouses and processes at Crescent Parts & Equipment through the COVID pandemic. With their data-first focus and Mitch’s exceptional coaching and experience, they transformed our business into a more supply chain-oriented organization, enabling us to grow while prioritizing employee safety and creating a better work environment. Supply Velocity’s expertise in Lean methodologies and their comprehensive evaluation of our customers have been instrumental in optimizing our operations and increasing customer satisfaction. We highly recommend Supply Velocity to any company seeking to implement Lean processes and enhance their supply chain efficiency.”

“Supply Velocity gave us the tools to analyze our business and processes based on the facts and numbers versus our perceptions. Our common quote was “Let the numbers lead us”. The key for our organization was how quickly we moved from classroom to actual project initiation. We were able to jump in, start using the tools and see a difference right away.

The get-into-action approach was good for our culture.”

“Isolating a problem, finding short, and long term solutions with measurable results is what was promised and results is what was delivered by Supply Velocity. Upon launch of the Lean Six Sigma Selling System, we knew more about our customers, our products, and were able to create a solid plan to increase sales of our most profitable products. Within months of implementation, our booked sales jumped 60% and our most valued customers were getting direct, active, and calculable attention.”

“C&R was struggling with labor productivity. The construction crews were often missing materials that they needed to do their work. This caused significant idle time. Supply Velocity, Inc. and C&R used value stream mapping and visual management tools to make dramatic improvements in operations. Most importantly, two years later C&R is sustaining and improving on the implementation. C&R’s return on investment was 11:1. C&R had a record year last year in both sales and profits and would not have been able to pull it off without the changes Supply Velocity, Inc. helped us make.”

“Your process encourages this group to work together, better communicate and have fun doing it.”

“We are pleased that Essex selected Supply Velocity, Inc. as our Lean Implementation Partner. At one facility, we have saved over $350,000 in work-in-process inventory, reduced throughput time from 2 weeks to minutes and increased inventory turns 3 to 8 times per year. All these results are in just 6 months. Our return of investment is very high.”

“Closure Medical recently completed a major reorganization in order to enhance our ability to rapidly create innovative medical devices. We hired Supply Velocity to help us map out the process and service flows of the new organization that would maximize our product development process (PDP). In four weeks, Supply Velocity helped us envision a new PDP structure, develop measures and accountability for each step, and gain consensus within the organization. Supply Velocity’s focus on speed and accountability helped us complete a critical project in a timely fashion.”

“Supply Velocity has provided the technical expertise and political capital to move our project forward. They have just the right amount of push and the right amount of support. Supply Velocity has helped us make real changes to improve efficiencies in logistics without jeopardizing our performance. We’re happy and our customers are happy.”

“We used Supply Velocity on our Warehouse optimization project. One of the key characteristics of Supply Velocity is that they listened to our requirements and provided a clear path for our Warehouse processes using lean tools and our future sales growth as objectives.”

“Our experience with Supply Velocity was one of the best values we have ever had from a consulting project. Cyril Narishkin brought a structured lean methodology, invaluable experience and engaging facilitation skills to help us streamline a very complex and disjointed sales order process. Just as importantly, our team now has the knowledge and process competencies to address other business improvement opportunities going forward.”

“Supply Velocity is driving instrumental change in our inventory management processes. This is critical for us to be competitive in a supply chain environment with numerous disruptions. They are making change happen, which can be challenging in a 182 year old organization.”

“We engaged with Supply Velocity to help us embed process improvement at all levels of the business. Our team learned from Mitch to let the data drive decisions, to use Lean tools to help us see our processes critically and objectively, and to create a control plan to manage all of the tasks that were the outcome of the data study.The project turned out to be very significant to the company and most importantly, our customers. We reduced our customer wait times by 40%, and cut in half the labor cost to fulfill customer orders.

Some results are not able to be measured. However, as a result of this project, we have started to build a Lean mindset and culture, which is part of our strategic mission to save our customers money. Supply Velocity has been a valued partner in this mission.”

“Supply Velocity has helped Clean succeed in a number of ways. First, they provided the education that kicked off our Lean Process Improvement journey. They also facilitated a number of large supply chain and process improvement projects including: 1) building quality into our direct-labor productivity incentive program, 2) designing the layout of our garment warehouse, and 3) streamlining our route service process.We have integrated the methods that Supply Velocity taught us into our management and strategic planning. In the process our quality measurement has improved 22% from 2013 to 2015, we have reduced required annual labor by 2200 hours from the garment facility layout project and we’ve seen 50% decrease in error rate. Obviously the numbers speak for themselves, but just as important, Supply Velocity has been fun to work and have become true partners. They have “taught us how to fish” so our internal teams are able to implement change on their own, with the skills we learned from Supply Velocity. This relationship has been invaluable.”

“The role of the Erie Insurance Marketing Department has been evolving over the past several years – from a support role to a more critical role of driving growth in our organization. Because of our increased workload and desire to prioritize the most critical projects, we hired Supply Velocity to teach us the skills of Lean Six Sigma.Participants included the Promotions, Market Research and Agency Licensing sections of the Marketing Department.

We learned valuable tools to help us to prioritize based on the voice of the customer.

I firmly believe these skills made a difference in how we work every day. We are moving new projects forward, eliminating or changing ineffective processes, and we are a much stronger department. We continue to use the tools to help us with our highly-complex and time-consuming projects. Supply Velocity helped us to accomplish our goals.”

“Anheuser-Busch Precision Printing had been implementing Lean Operations on our own for the past two years. We needed to move faster and partnered with Supply Velocity, Inc. Through Supply Velocity, Inc.’s mathematical workflow balancing and visual management tools, dramatic improvements were achieved. The entire converting operation was rearranged based on Lean principles. The result is a 20.6% productivity improvement, enabling us to operate with 23 fewer people in production.”

“We used Supply Velocity to rethink our sales process. By analyzing the entire process we found wasted time in our Sales, Admin and Operations departments. Streamlining this process created extra time for each Sales Rep, allowing them to spend more time with Customers and increase the value we add. Gross profit margins are up 40%!We are now using Supply Velocity to help us rethink our entire Strategic Plan.”